Girls, try harder: money edition

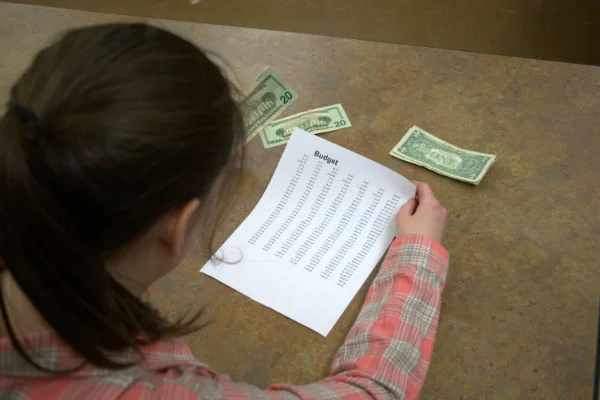

Build a budget to help that cash last all month. | PC: Jorrdan Bissell

This is the second article in the “Try Harder” series focusing on different problems and situations facing college students today and what we can do better. Today, we’re looking at the girls to really buckle down and try harder … with money!

Getting paid only once a month at Union College makes budgeting imperative. On the first of the month, everyone feels “fluuuuush with caaash!” (Parks & Recreation reference, anyone?) Why not spend $80 at Forever21 or buy fancy coffee every day for a week? But week two or three comes around and you can barely scrounge up the change for a pack of gum.

“You feel like you have an abundance of money in college and you can spend as much as you want … but nope,” says Debbie Pinto, a senior elementary education major. “Freshmen and sophomores, you might feel like you can just spend, but juniors and seniors, you know the need to budget is REAL.”

Learning how to talk about and handle money needs to start early! Budgeting needs to be a priority. Many females struggle when it comes to online shopping while others start hemorrhaging dollars on Target runs. A great way to maintain this limit is to have an accountability partner. Maybe your friend or roommate is always commenting on your clothes or purchases and is aware of when you have new things. Just ask her to keep you accountable when it comes to spending dollars! Or at least ask your peers to stop encouraging you to spend. We’ve all experienced that extra push from our pals when that dress “looks so good on you!” No more of that.

“I am careless and don't plan,” says Rachel Lozano, a senior business administration student.

“A simple solution is taking the extra minute to see how many times can I [actually] afford to go out in a week. What's my cap on coffee this week? (said no one ever) And sometimes, do I even have a dollar in my pocket right now?” Something to be mindful of is how much time and resources you spend shopping. Set a monthly limit for yourself, either a time or money limit. Money can be a huge source of tension. An article written by NPR writer Chris Arnold, discusses the implications of money in a relationship. “Disagreements about money are one of the most difficult conflicts for people in relationships to resolve. There's little instruction in how to manage our finances with a spouse or partner. And if you do it wrong, it can mess everything up.”(http://www.npr.org/2016/03/08/469239033/how-to-keep-money-from-messing-up-your-marriage) As Pinto looks forward to post-graduation and managing joint finances with her future husband, Abner Campos, it can be daunting. But there are ways to make that transition manageable! “It’s better for us to know individually how to budget so we can budget better in our marriage,” continues Pinto. “You don’t want to be dependent on one person to solve those problems for the couple. ”

“Guys like girls who budget,” says Justin Cook, a junior accounting and finance student. “Or at least I do.”

There are many fun apps to make budgeting a little easier. Mint connects to your bank account and shows you exactly where you’re spending and where you could be saving. Mvelopes is also a great app for tracking spending in real time and its user-friendly interface is fun and pretty. Spendee is another top rated budget app for 2017, with a bright dashboard and both free and premium options.

It might be hard to stop yourself from buying a new jacket or an expensive breakfast at Cultiva but making that decision just comes down to a new mindset. “It’s all about goals and priorities,” says Jon Rickard, director of student accounts in Student Financial Services. “If you have a goal and it’s more important to you, you’ll focus your resources to meeting that objective. It’s all about goal setting.”

Katie Morrison is a senior studying business administration.